Not known Facts About A&a Works

Not known Facts About A&a Works

Blog Article

All About A&a Works

Table of ContentsGet This Report on A&a WorksA&a Works - TruthsHow A&a Works can Save You Time, Stress, and Money.The Ultimate Guide To A&a WorksMore About A&a WorksThe Buzz on A&a Works

There are multiple renovation finance alternatives for individuals that intend to borrow money to improve or remodel their home. Loans that utilize your home as security, consisting of home equity loans and HELOCs, can have tax advantages. Lendings that do not count on home equity are additionally an alternative, but generally have higher interest rates.

Whether you're looking to remodel your kitchen area, mount a home office or complete your basement, any major home enhancement is mosting likely to call for some significant cash. A home remodelling lending could be your course to getting the project underway faster than you think (A&A Works). This guide describes funding choices for your home upgrades and exactly how to get a renovation financing

There are a number of circumstances where you might intend to consider this loan type: Your home needs an immediate repair work (a pipes issue, as an example) or gets on the brink of one (sinking structure) and you do not have the money handy to pay a specialist. Or, it's an optional undertaking, yet you don't intend to blow the spending plan or deplete the interest-bearing account for it.

About A&a Works

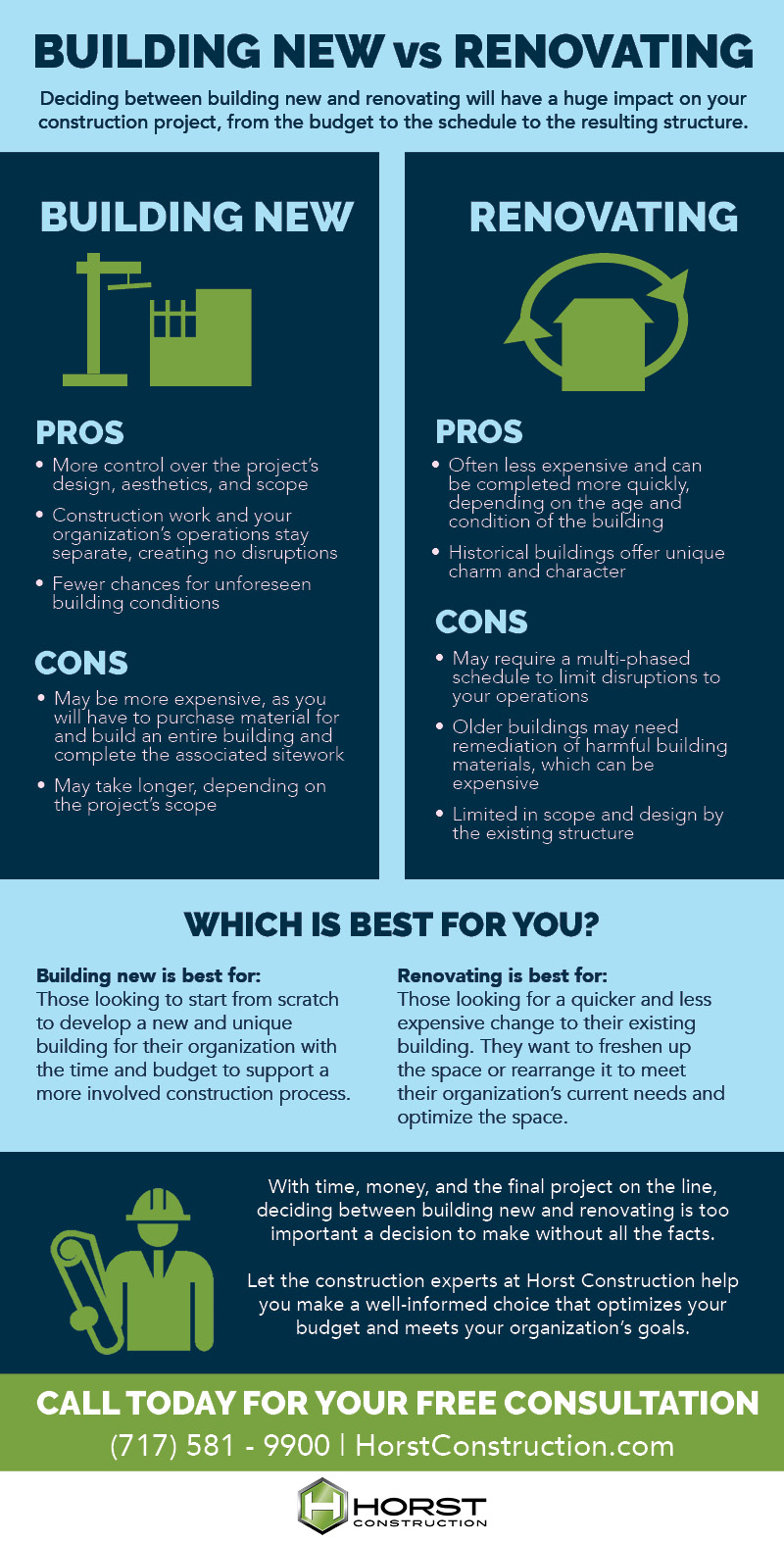

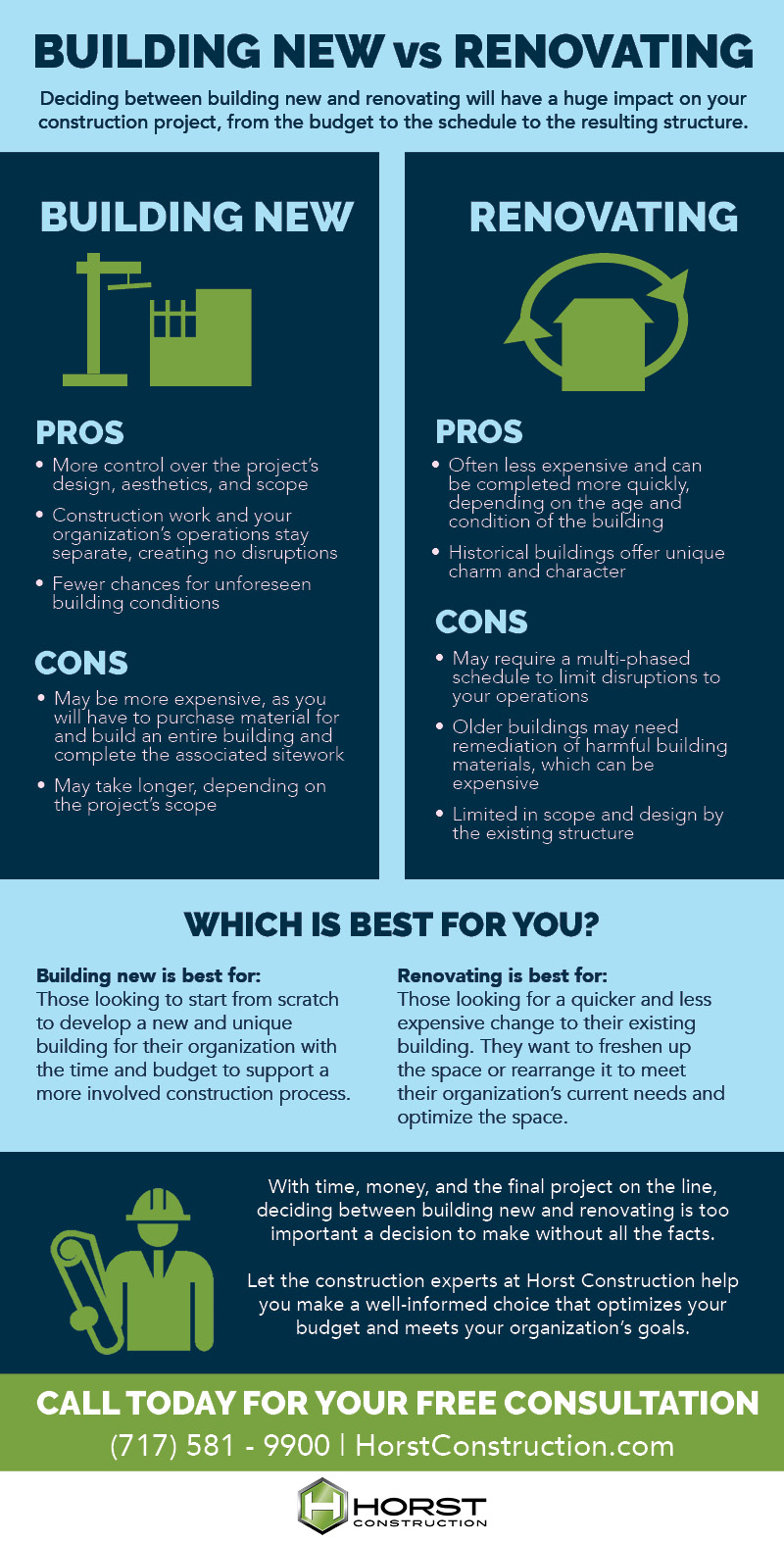

One vital way to boost the well worth of your possession risk in your home (besides paying for your home mortgage) is to enhance the home itself. Strategically-selected remodellings can be a smart financial investment, improving your home worth and making your home a more comfortable area to live. If you are wanting to note your home, nothing adds an open market edge like projects that expand the habitable space or maintain the home up-to-date and practical.

Before using for any finance, keep in mind that your credit history plays a crucial duty in securing in the cheapest passion rate. If you have time, think about taking steps to improve your rating by paying down credit scores card bills and making all repayments on time. Will you require to lease a location to live somewhere else while the project is happening?

In this means, the loan is a financial investment that can increase the home's value. You can certify with a deposit as low as 3 percent if you're a novice purchaser getting a fixed-rate car loan and you prepare to live in the home. It might include lower rate of interest rates and shorter settlement terms than standard renovation lendings.

Fees and shutting prices may be greater than other kinds of mortgage. However, via Fannie Mae's Area Seconds program, you may be able to obtain up to 5 percent of your home's worth to assist cover the deposit and closing costs. Caret Down In an affordable actual estate market, a Fannie Mae HomeStyle Restoration funding may not be ideal if you're aiming to protect an offer quick.

Some Known Facts About A&a Works.

Your service provider should develop a building timetable and strategies for your remodelling. You have to also submit a residential or commercial property evaluation referred to as an "as-completed" assessment. Like the Fannie Mae HomeStyle Renovation finance, the FHA 203(k) lending a government-backed standard rehab finance funds the home purchase and its restorations. The Federal Housing Administration insures this finance, and its objective is to create more alternatives for property owners or purchasers of homes that require recovery and fixing.

You may be qualified for a bigger tax reduction (the bigger financing combines improvement and home acquisition). Any remodeling is restricted to the FHA's list of eligible tasks.

The car loan is additionally just for main homes, not second homes or holiday residences.

What Does A&a Works Do?

Home equity fundings come with fixed rates of interest and repayment quantities that continue to be the exact same for the life of the loan. With a HELOC, you can draw funds as you need and only pay rate of interest on what you attract. You might be able to deduct the rate of interest if you detail on your income tax return.

You can't draw funds only as required with home equity loans as you can with HELOCs. Rates of interest vary with HELOCs, which indicates your price and settlement can increase. Qualifications may be extra stringent: You need to have and maintain a specific amount of home equity. Caret Down Closing expenses vary from 2 percent to 5 percent of the funding amount.

8 Simple Techniques For A&a Works

A cash-out re-finance can have the dual benefit of letting you re-finance a higher-rate home mortgage to one with a reduced price while drawing out cash money to spruce up your residential or commercial property. A lower rate and a boost in home value as a result of remodellings are excellent long-lasting benefits.

Caret Down You must utilize your home as collateral. You must have at the very least 20 percent equity in your home to be read this article qualified.

What Does A&a Works Do?

You can combine financial debt from numerous high-interest charge card into one funding with reduced rate of interest. You can receive funding as fast as the same day or the following organization day. The majority of individual loans are unsecured, meaning you won't need to use your home as security. Caret Down They usually have higher rate of interest than home equity finances and HELOCS and cash-out refis (considering that the finance is unprotected).

Individual finances likewise offer the debtor my review here lots of leeway regarding the sort of improvements that they can make. Lenders likewise have a lot of freedom concerning the quantity of rate of interest they can charge you. Basically, if you're obtaining money at a 25 percent passion rate, you're mosting likely to pay even more than may be required to complete your project.

Don't let your upgrade come with any of these drawbacks: Are you planning on marketing this home in the near future? When thinking about renovations, maintain in mind that the complete cost will probably include even more than simply labor and products.

Report this page